17+ Immediate annuity

Calculating Present and Future Value of Annuities. Multi-year guaranteed annuities or MYGAs are a type of fixed annuity.

Bajaj Allianz Life Guaranteed Pension Review Goodmoneying

When you buy an income annuity you enter into a contract with a life insurance company in which the insurer agrees to make fixed monthly income payments in exchange for a lump sum of money.

. 369 An NRCFI includes a financial institution that qualifies as a restricted fund as described in the relevant US. 300 immediate deduction tests. A life annuity is an annuity or series of payments at fixed intervals paid while the purchaser or annuitant is aliveThe majority of life annuities are insurance products sold or issued by life insurance companies however substantial case law indicates that annuity products are not necessarily insurance products.

In June according to LIMRA the three-year average interest rate for a fixed-rate deferred annuity was 298 compared to an average interest rate of 064 for a three-year CD. Also known as fixed-rate or CD-type annuities Multi-Year Guarantee Annuities MYGA provide a predetermined and contractually guaranteed interest rate for a set period of time typically 3-10 years. An annuity that begins paying out immediately is referred to as an immediate annuity.

Receive guaranteed income for life with an Immediate Annuity. Annuity or renewal fee on or to. For an SPIA you pay a single lump sum upfront the premium in bulk.

While annuity buyers typically choose to receive payments monthly you may choose quarterly or even yearly instead. 17 is divided into four parts. If you are covered by the Federal Employees Retirement System you must use SF 3107 to apply for an immediate annuity retirement.

Reviewed by David Kindness. Annuity Rates Quotes Multi-Year Guarantee Annuities MYGA Share. Retrieved from httpswwwthinkadvisor.

Annuities can be purchased to provide an income during. Accounting for Absence During COVID-19 Response. And final agency regulations supplementing this part shall be submitted to the Secretary at the office set out in 40117 for approval for consistency with this part before they are submitted to the.

It is important to note that regardless of which option is chosen once applied the choice is irrevocable. Should you decide to wait to collect payments you have a deferred annuity. Tax Return for Seniors and their three Schedules 1 through 3.

Best Fixed Annuity Rates For September 2022. NGB-J1 Policy White paper COVID-19 and T32 IDT_20200313. Updated June 17 2022.

Each part is further divided into chapters most of which generally discuss one line of the form or one line of one of the three schedules. Individual Retirement Annuity Definition. Currently Sentinel Security Life offers the best fixed annuity rate at 475 available in a 10 year fixed annuity.

DOD INSTRUCTION 620003 PUBLIC HEALTH EMERGENCY MANAGEMENT PHEM WITHIN THE DOD. One Size Does Not Fit All. Hes distributed more than 15 Billion in annuities over a 17-year career.

When choosing an immediate annuity you can choose how frequently you receive payments often referred to as the mode. What Is an Immediate Payment Annuity. It is a trust that holds investment assets purchased with a taxpayers earned income for the taxpayers eventual benefit in old age.

Transferring the seniors and pensioners tax offset. Calculating Present and Future Value of Annuities. The table below lists the annuities with the best guaranteed annuity rates for September.

In most instances immediate annuity payments are sent to you starting one month after you buy your annuity. Serving in many roles including RVP at the largest independent Annuity Brokerage Firm VP of Marketing at a top Insurance Company and Regional Director in the Private Client Group at a Fortune 500 Company. When you purchase an annuity if you decide to start receiving payments within a year you have an immediate annuity.

Individual Retirement Annuity Definition. If you are applying for disability retirement. In return your insurer promises to give you monthly payouts of a certain amount for the.

Payments can be distributed over a specific period of time. Treasury Regulations see section 11471-5f1iD applying the procedures of Annex I of the Agreement instead of the procedures required under section 11471-4 of the US. For retirement with an immediate annuity annuity commencing within one month after the date of separation on which title to annuity is based this package is for you.

A Medicaid annuity is structured as a single premium immediate annuity SPIA. They guarantee you will get a specific interest rate for 2-10 years with tax deferralMYGAs are subject to surrender charges which an annuity owner must pay if they cancel the annuity before the term is overHowever MYGAs do offer limited liquidity during the. Individual Income Tax Return and Form 1040-SR US.

Fixed annuities provide a set annuity rate for a guaranteed period of time typically from two to ten years. 17 May 2022 QC 31987. Monthly quarterly semiannually or annually.

Calculating Present and Future Value of Annuities. So for instance at age 55 a 500000 annuity would pay 1825 per month or 21900 annually with payments beginning immediately. 6 to 30 characters long.

Must contain at least 4 different symbols. Immediate Office of the Director IMOD Office of Policy for Extramural Research Administration OPERA. ASCII characters only characters found on a standard US keyboard.

Immediate annuity longevity annuity Qualified Longevity. An individual retirement account IRA in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. An individual retirement account is a type of individual retirement.

Single Premium Deferred Annuities. Treasury Regulations and applying references to. What Is an Immediate Payment Annuity.

Whether buying an immediate annuity or converting a deferred annuity into income payments the options are essentially the same. If you are 70 a 500000 annuity would pay you 2605 per month beginning. Get income annuity quotes using the annuity calculator on this page or call 800 872-6684 for quick answers to all your annuity questions.

You can claim a deduction to reduce the taxable amount on income you receive from a foreign pension or annuity that also has an undeducted purchase price UPP. You elected to continue your coverage and 4. You were insured for the five years of service immediately before your annuity commencing date or for the entire periods during which the coverages were available to you and 3.

You retired on an immediate annuity one which began within a month after you separated and 2. Using an annuity calculator I ran annuity quotes to determine what a 500000 annuity would pay you per month with payments beginning immediately for ages 55-70. 17 closely follows Form 1040 US.

Hdfc Pension Plan Super Pension Plus Should You Buy For Retirement

Bajaj Allianz Life Guaranteed Pension Review Goodmoneying

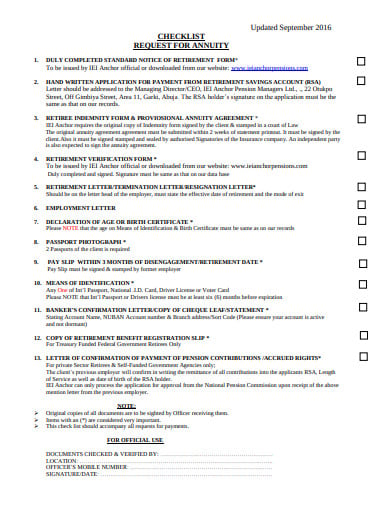

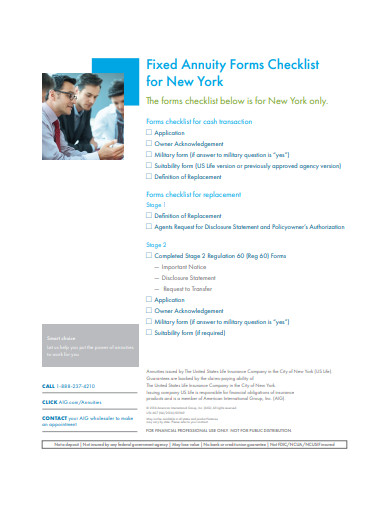

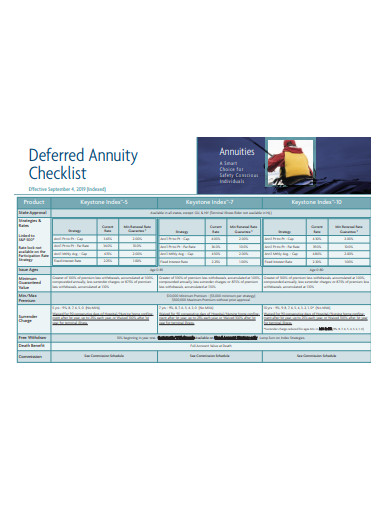

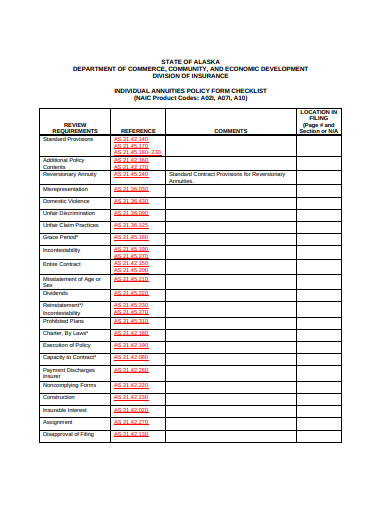

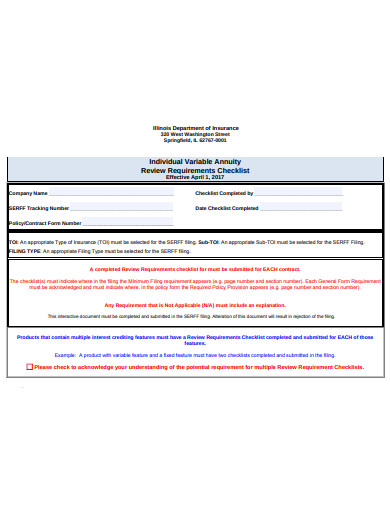

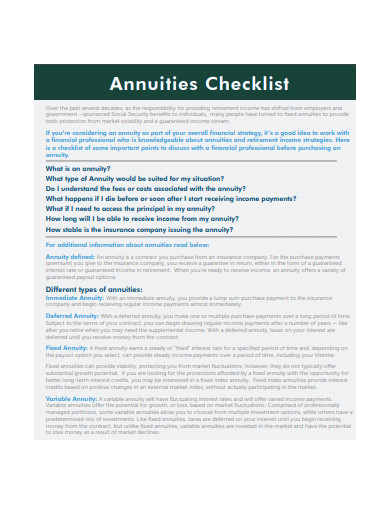

8 Annuity Checklist Templates In Ms Word Pdf Free Premium Templates

8 Annuity Checklist Templates In Ms Word Pdf Free Premium Templates

Hdfc Life New Immediate Annuity Plan Review Goodmoneying

8 Annuity Checklist Templates In Ms Word Pdf Free Premium Templates

8 Annuity Checklist Templates In Ms Word Pdf Free Premium Templates

Hdfc Life New Immediate Annuity Plan Review Goodmoneying

Hdfc Life New Immediate Annuity Plan Review Goodmoneying

Pin On E Stuff

8 Annuity Checklist Templates In Ms Word Pdf Free Premium Templates

Bajaj Allianz Life Guaranteed Pension Review Goodmoneying

8 Annuity Checklist Templates In Ms Word Pdf Free Premium Templates

Difference Between Immediate Annuity And Deferred Annuity Plans How To Plan Single Premium Annuity

Hdfc Life New Immediate Annuity Plan Review Goodmoneying

What Happens If A Person Dies At The Age Of 62 Under The Nps Plan What Happens To The Remaining Fund Value Quora

Hdfc Life New Immediate Annuity Plan Review Goodmoneying